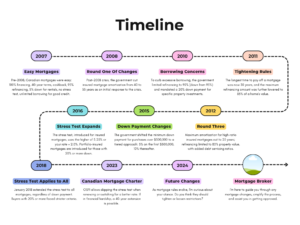

Mortgage Rule Transformations Since 2008

Embarking on the pathway to homeownership has always been a significant life milestone and, for Canadians, navigating the twists and turns of the mortgage landscape is an integral part of this

journey. Over the years, the rules and regulations governing mortgages have undergone a profound transformation, responding to the shifting tides of economic landscapes and financial stability. As we delve into this intricate timeline, our goal is to unravel the evolution of Canadian mortgages, making sense of the changes that have shaped the way we buy and finance our homes.

Before 2008: Easy Mortgage Times

Back in the days before 2008, getting a mortgage in Canada was pretty easy. People had lots of options:

- You could get 100% financing (that means no down payment).

- Mortgages could last for 40 years.

- Some mortgages even gave you cashback after closing.

- Refinancing let you borrow up to 95% of your home’s value.

- You needed just a 5% down payment for rental properties.

- Getting a mortgage had no stress test, and if you had good credit, there were no limits on how much you could borrow

July 2008: First Round of Changes

After the financial crisis in 2008, the government made the first set of changes. The maximum time to pay off an insured mortgage (amortization) was reduced from 40 to 35 years.

February 2010: Responding to Borrowing Concerns

People were borrowing a lot against their homes, so the government made more changes. The maximum refinancing amount was lowered to 90% of a home’s value, down from 95%. They also said you needed a 20% down payment for certain types of property investments.

January 2011: Tightening the Rules

Things got even tighter. The longest time to pay off a mortgage was now 30 years, and the maximum refinancing amount was further lowered to 85% of a home’s value.

June 2012: Third Round of Tightening

The maximum amortization period was further reduced to 25 years for high-ratio insured mortgages.Refinancing rules faced their third tightening, setting a new maximum loan of 80% of a property’s value. Additionally, another significant change limited the availability of government-backed insured high-ratio mortgages to homes valued at less than $1 million. The government also implemented a cap on both the gross debt service (GDS) ratio, limited to 39%, and the total debt service (TDS) ratio, capped at 44%. These measures collectively sought to curtail the risk associated with high-ratio mortgages and promote responsible borrowing practices.

December 2015: Liberal Government Steps In

The government introduced a tiered down payment approach for homes over $500,000. Under this system, if you purchased a $750,000 home, you’d put 5% down on the first $500,000 ($25,000) and 10% on the remaining $250,000 ($25,000), making the total down payment $50,000. This change increased the minimum down payment by $12,500 from the previous flat 5% rate, for this specific scenario.

October 2016: Stress Test Expands

In 2016, significant changes occurred. Mortgages with less than 20% down required a “Stress Test,” where your application was reviewed based on a new “Qualifying Rate,” not your actual mortgage rate. The Qualifying Rate was set at 5.25% or your mortgage rate + 2.0%, whichever was higher. This change aimed to ensure Canadians could handle potential rate increases, reducing payment shock.

Additionally, those with 20% or more down had to follow the same rules as insured mortgages. Even without paying for default insurance, borrowers aiming for better rates were placed in Portfolio-Insured mortgages. However, this meant adhering to rules like a 25-year amortization, a purchase price under $1,000,000, and owner-occupied status (excluding rentals).

January 2018: Stress Test Applies To All

In January 2018, the stress test was expanded to include all mortgages, irrespective of the down payment size. Homebuyers with a down payment of 20% or more, along with those refinancing properties with at least 20% equity, faced more rigorous qualifying criteria.

2023: New Changes

OSFI, the guideline overseer, now lets you skip the stress test when renewing your mortgage and switching lenders for a better rate. If you’re in financial hardship due to rising interest rates, they might allow you to extend your mortgage to 40 years. The Canadian Mortgage Charter suggests lenders offer relief, like extending payment periods, waiving fees, and allowing lump sum payments or selling homes without penalties. It’s crucial for homeowners facing challenges due to rapid rate increases. However, note that the Charter is currently just rules, not yet the law.

Conclusion: Mortgages Keep Changing

Reflecting on the journey, it’s evident that Canadian mortgages have undergone significant transformations. Each adjustment seeks equilibrium between housing market stability and ensuring accessibility for homebuyers. As we look ahead, it’s crucial for you to consider the implications of these changes on your homeownership aspirations in Canada. What are your thoughts on these shifts, and how do you envision the future as rules continue to evolve? Your perspective is key in navigating the ever-changing landscape of Canadian mortgages.