What To Do If Canada Enters A Recession

Recessions can feel scary. But, before a recession hits, most Canadians can feel it coming.

Here’s what to look for and how to react should a recession hit Canada in 2023.

What is a Recession?

A recession occurs after six months of negative gross domestic product (GDP). GDP refers to a situation where a country’s economy is contracting or shrinking, rather than growing. A negative GDP can be a sign of economic recession or depression. This may result in people losing their jobs, businesses closing, and consumers buckling up and spending less money.

Why do Recessions Happen?

Recessions are naturally a part of the economic cycles and happen to regulate monetary policy, but that doesn’t help consumers who can’t make ends meet.

Some common reasons recessions occur include the following:

- Out-of-control inflation – If the government has to step in to handle inflation, it can raise interest rates considerably, which deflates most businesses’ capabilities

- Negative economic events – The pandemic is a good example of a negative economic event no one saw coming, and it swept the entire world

- Debt bubbles – When businesses have excessive debt, and interest rates increase to the point they can’t afford their loans, it hurts the economy.

What Happens to Canadians during a Recession?

Now that you know why a recession might occur, how does it affect consumers?

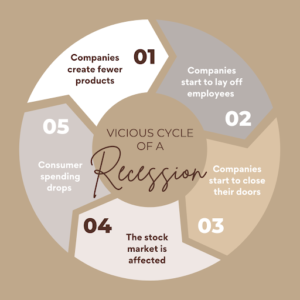

If the economy goes into recession, it means companies create fewer products. Production slowdown usually results in layoffs and businesses closing. This can also affect the stock market and, eventually, consumer spending because consumers become too afraid to spend the money they have.

This creates a vicious cycle. Consumers don’t spend, so businesses stop producing, which means more layoffs and a hiring freeze. Consumer confidence falls, and the entire country goes into what feels like a depression.

Fortunately, a recession isn’t a depression. Recessions are temporary, usually less than one year, while depressions last multiple years.

How the Government Steps In

Just as the government will step in when the economy suffers from high inflation, they also step in during a recession.

Instead of increasing interest rates, they typically lower them. This makes it easier for businesses and consumers to borrow and recycle money throughout the economy. As a result, businesses can get back to producing more and eventually hire more help and consumers’ confidence will increase in the economy, allowing them to spend again.

Preparing for a Recession

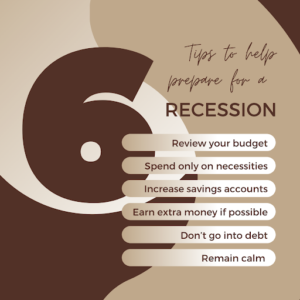

If you’re worried about a recession occurring, here’s how to prepare:

- Spend only on necessities

- Don’t go into debt

- Increase your emergency fund

- Consider additional income streams

- Review your budget and investment plan

- Remain calm, and don’t bail out of your investments

Final Thoughts

Recessions don’t last forever, so don’t make drastic changes to account for them. When the recession passes, you’ll be back to your ‘old ways’ and can spend with more confidence. But, for the time being, prepare yourself for the worst so you don’t suffer financially if the economy hits rock bottom.